Cashless Digital Transaction Boosted in Fast Economically Growing India | This Could Be a Model for the World

A cashless society wasn’t the original goal of the country’s sudden currency ban in November 2016. But when an acute shortage of banknotes gave a fillip to digital wallets, that purpose was added as an afterthought to justify an act of farcical state overreach.

The real innovation in mobile payments in India began a few months prior to the cash ban. It’s called a unified payment interface, or UPI. The idea is simple and easy to understand for consumer One smartphone owner who’s a customer of Bank A can request a payment from, or initiate a payment to, another owner who has an account with Bank B. Neither party needs to know anything more than each other’s mobile number or a virtual ID. They don’t even need to use the same mobile app to transact.

In this, India was ahead of even Asian money centers like Singapore and Hong Kong. With more than 140 Indian banks sharing the interface, and Alphabet Inc.’s Google and Facebook Inc.’s WhatsApp offering instantaneous payment services on it, UPI has become a keenly watched experiment. Things are going well: From nothing to 800 million monthly transactions in less than three years, India’s UPI has taken off. Growing smartphone use and lowering data costs have helped immensely.

Now a committee set up by the central bank under Nandan Nilekani, the technology entrepreneur best known for creating the world’s largest repository of citizens’ biometric data, wants to expand the platform to foreign-currency remittances by the non-resident Indian diaspora as well as to settle residents’ payments when they travel overseas.

Who will succeed in this crowded field? News reports give a lead to Google, though that could change as people-to-merchant payments start to dominate people-to-people transactions. In e-commerce payments, competition will be stiff between Amazon.com Inc. and Walmart. Online sales, though, are a sliver of overall Indian retail. With more than 300 million subscribers for his Jio mobile service, Ambani now wants to win over small stores, which are reluctant to go cashless because of high card fees

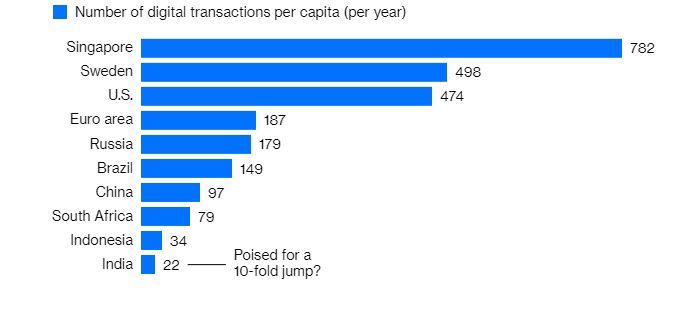

Despite all the drama around the currency ban, cash is still king in India. After growing fivefold in five years, annual per capita digital transactions have reached 22, compared with 34 in Indonesia and 782 in Singapore in 2017. Nilekani’s panel is pushing for 220 by March 2021. That’s a lot of transactions in a country of 1.3 billion people. With fair competition between local players and global tech, 10-fold growth may not be a pipe dream. Walmart shareholders, worried about the costly Flipkart acquisition, will be rooting for PhonePe. Masayoshi Son and Warren Buffett will keep an eye on their Paytm stakes. Everyone will watch Ambani.